Financial Planning

Your personal Chief Financial Officer - You make the strategic decisions, we make the numbers work.

Comprehensive Financial Planning for real people.

Financial Planning is more than just buying some mutual funds and calling it a portfolio…

Financial Planning brings every part of your financial life into consideration and then make the pieces work together in harmony.

Cash Flow

Debt

Income Planning

Tax Planning

Retirement Plans/ Planning

Investment Management

Insurance / Risk Management

Estate Planning

Charitable Giving

Philanthropic Strategy

Business Exit Planning

and more…

Wow, that’s a lot.

Most advisors only focus on 1 or 2 of those areas…

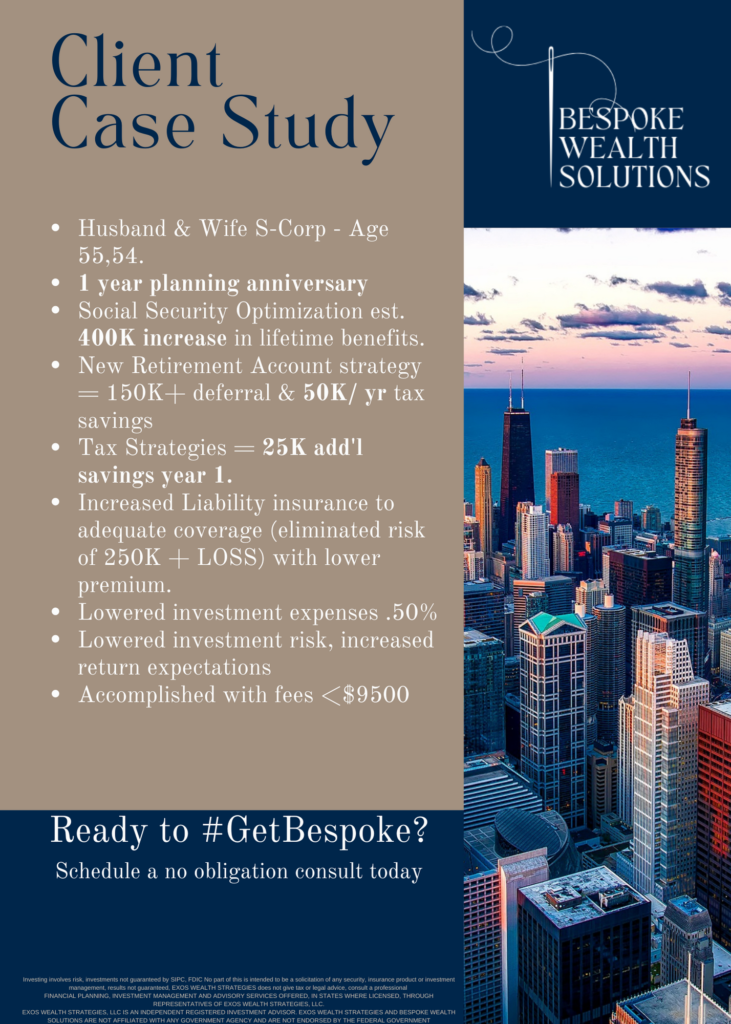

See what you’ve been missing:

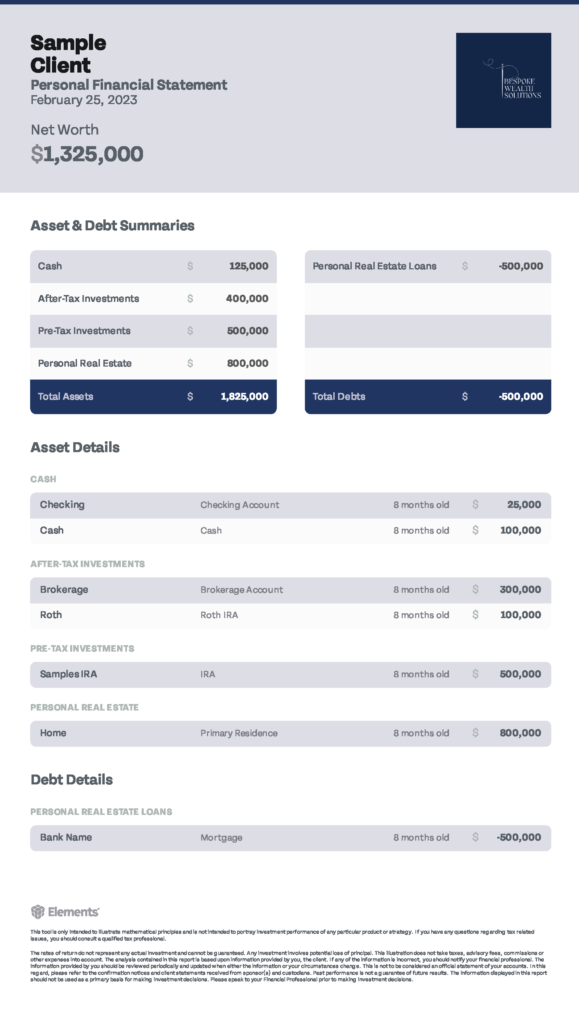

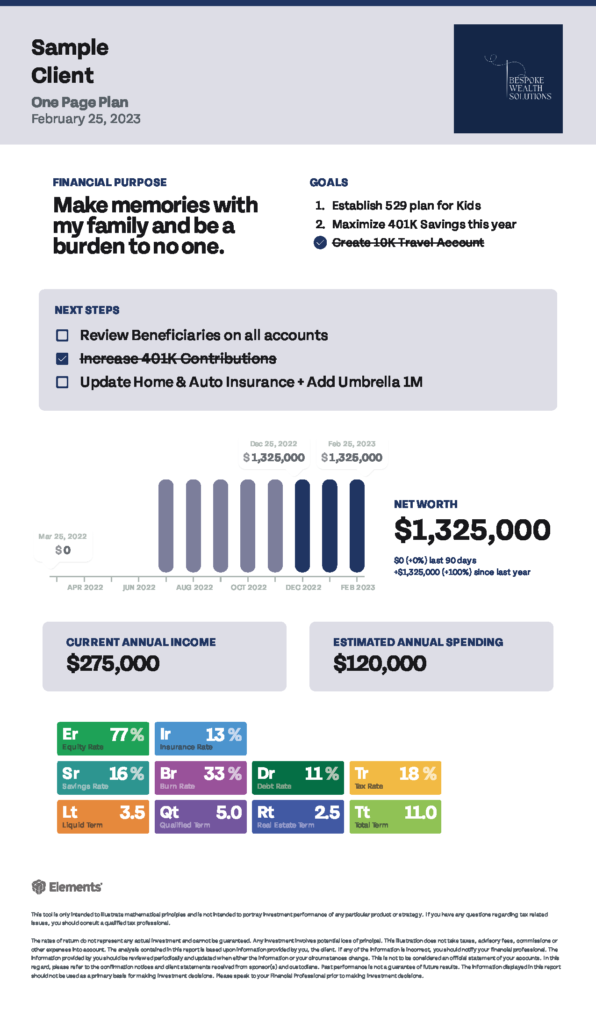

PLAN EXAMPLES

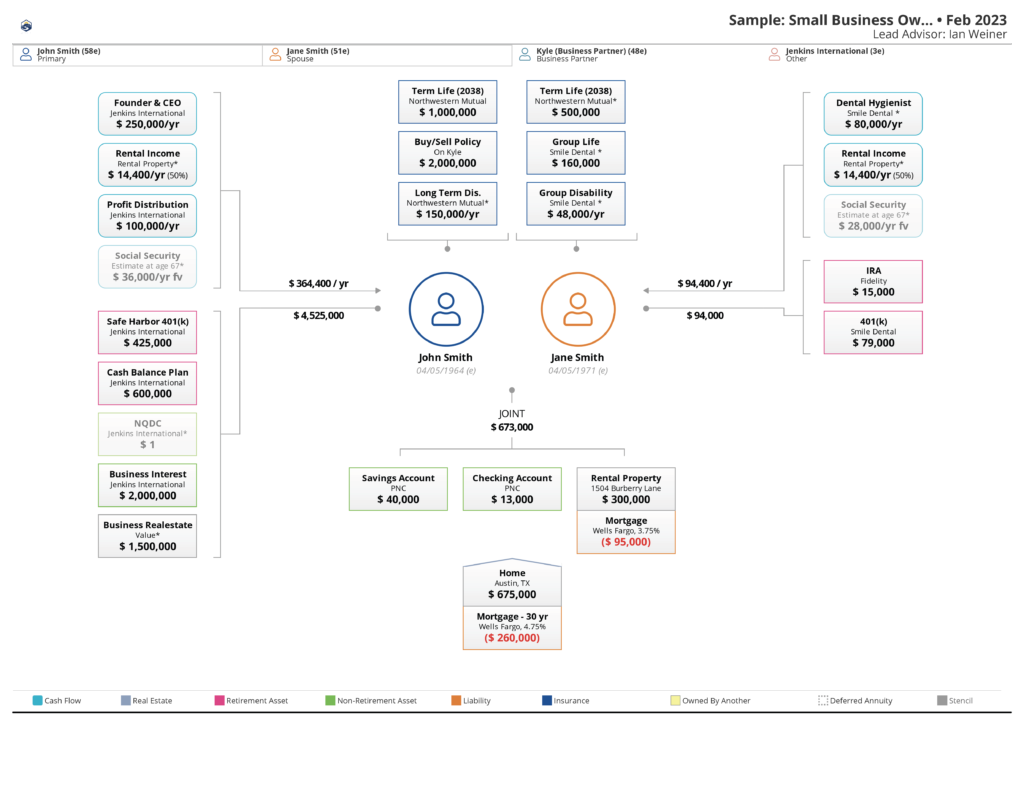

ASSET - MAP

LETS GET ON THE SAME PAGE, LITERALLY

In order to create a truly custom plan, we need to see all of the pieces in one place. That's the power of Asset - Map. We can model changes, determine where risk exists and what steps to take, quickly and collaboratively.

When you see your Map for the first time, everything changes.

Ian Weiner, CFP®- Owner, Lead Planner

Additional Deliverables

ONGOING PLANNING WITH ELEMENTS(R)